VIDEO ANSWER: Hello students, there is a question. Matrack began and ended their inventory in November. There are 30 direct materials on November 1st. There are 145,000 and 171,000 of work in progress. The finished goods cost 85,000 and 78,000. There

Dynamics 365 Business Central: Using the Date Method to retrieve only the Day, Month, and Year Data in Queries [Group by Year-month] | Dynamics 365 Lab

During January, its first month of operations, Dieker Company accumulated the following manufacturing costs: Raw materials $4,500 on account, factory labor $8,100 of which $5,300 relates to factory wages payable and $2,800 relates to payroll taxes payable, and factory utilities payable $2,700. Required:

Source Image: mathlearningcentre.com

Download Image

During January, its first month of operations, Dieker Company accumulated the following manufacturing costs: raw materials $4,800 on account, factory labor $7,900 of which $5,400 relates to factory wages payable and $2,500 relates to payroll taxes payable, and utilities payable $2,700.

Source Image: youtube.com

Download Image

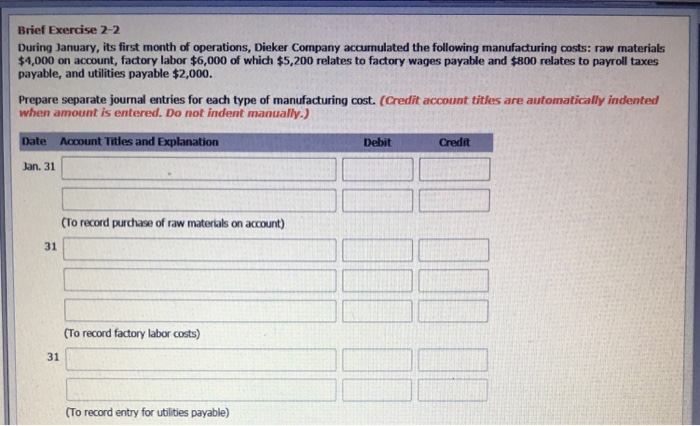

Solved Brief Exercise 2-2 During January, its first month of | Chegg.com Please find the answer attached. Image transcriptions Brief Exercise 20-2 During January, its first month of operations, Dieker Company accumulated the following manufacturing costs: raw materials $5,100 on account, factory labor $7,100 of which $5,500 relates to factory wages payable and $1,600 relates to payroll taxes payable, and utilities payable $2,900.

Source Image: mathlearningcentre.com

Download Image

During January Its First Month Of Operations Dieker Company Accumulated

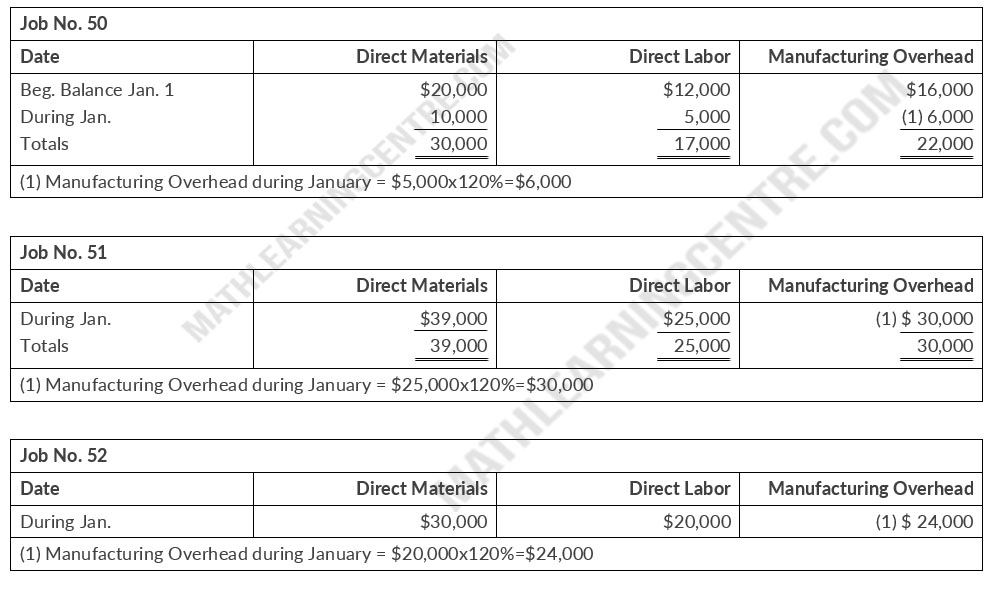

Please find the answer attached. Image transcriptions Brief Exercise 20-2 During January, its first month of operations, Dieker Company accumulated the following manufacturing costs: raw materials $5,100 on account, factory labor $7,100 of which $5,500 relates to factory wages payable and $1,600 relates to payroll taxes payable, and utilities payable $2,900. During January, its first month of operations, Dieker Company accumulated the following manufacturing costs: raw materials purchased $4,000 on account, factory labor incurred $6,000 of which $5,200 relates to factory wages payable and $800 relates to payroll taxes payable, and factory utilities payable $2,000.

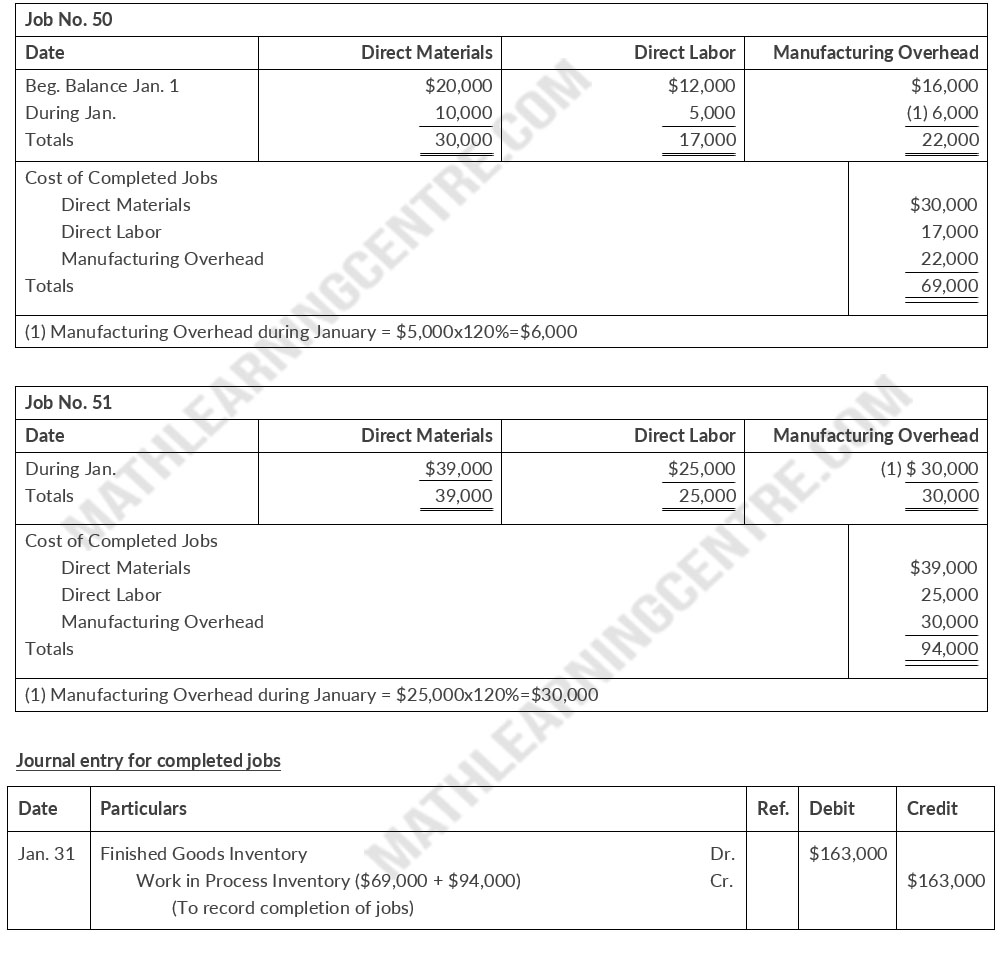

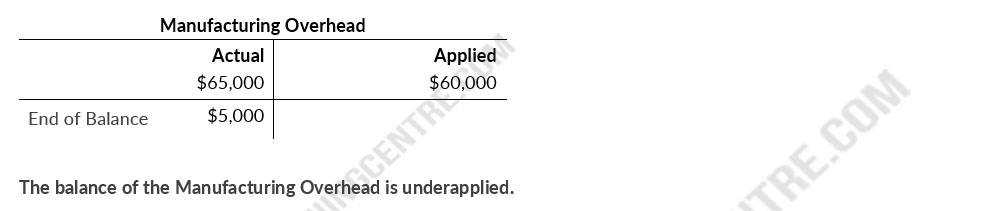

Lott Company uses a job order cost system and applies overhead to productions on the basis of direct labor costs.

During January, its fi rst month of operations, Dieker Company accumulated the following manufacturing costs: raw materials $4,000 on account, factory labor$6,000 of which $5,200 relates to factory wages payable and$800 relates to payroll taxes payable, and utilities payable $2,000. First day of new job work hi-res stock photography and images – Alamy

Source Image: alamy.com

Download Image

QUniverse Fall 2023 by Quincy University – Issuu During January, its fi rst month of operations, Dieker Company accumulated the following manufacturing costs: raw materials $4,000 on account, factory labor$6,000 of which $5,200 relates to factory wages payable and$800 relates to payroll taxes payable, and utilities payable $2,000.

Source Image: issuu.com

Download Image

Dynamics 365 Business Central: Using the Date Method to retrieve only the Day, Month, and Year Data in Queries [Group by Year-month] | Dynamics 365 Lab VIDEO ANSWER: Hello students, there is a question. Matrack began and ended their inventory in November. There are 30 direct materials on November 1st. There are 145,000 and 171,000 of work in progress. The finished goods cost 85,000 and 78,000. There

![Dynamics 365 Business Central: Using the Date Method to retrieve only the Day, Month, and Year Data in Queries [Group by Year-month] | Dynamics 365 Lab](https://yzhums.com/wp-content/uploads/2021/06/image-188-1024x468.png)

Source Image: yzhums.com

Download Image

Solved Brief Exercise 2-2 During January, its first month of | Chegg.com During January, its first month of operations, Dieker Company accumulated the following manufacturing costs: raw materials $4,800 on account, factory labor $7,900 of which $5,400 relates to factory wages payable and $2,500 relates to payroll taxes payable, and utilities payable $2,700.

Source Image: chegg.com

Download Image

Lott Company uses a job order cost system and applies overhead to productions on the basis of direct labor costs. Question: During January, its first month of operations, Dieker Company accumulated the following manufacturing costs: raw materials $5,700 on account, factory labor $6.300 of which $5.500 relates to factory wages payable and $800 relates to payroll taxes payable. and factory utilities payable $2,700 Prepare separate journal entries for each typ

Source Image: mathlearningcentre.com

Download Image

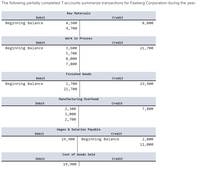

Answered: The following partially completed… | bartleby Please find the answer attached. Image transcriptions Brief Exercise 20-2 During January, its first month of operations, Dieker Company accumulated the following manufacturing costs: raw materials $5,100 on account, factory labor $7,100 of which $5,500 relates to factory wages payable and $1,600 relates to payroll taxes payable, and utilities payable $2,900.

Source Image: bartleby.com

Download Image

SigEp Journal – Spring 2014 by Sigma Phi Epsilon – Issuu During January, its first month of operations, Dieker Company accumulated the following manufacturing costs: raw materials purchased $4,000 on account, factory labor incurred $6,000 of which $5,200 relates to factory wages payable and $800 relates to payroll taxes payable, and factory utilities payable $2,000.

Source Image: issuu.com

Download Image

QUniverse Fall 2023 by Quincy University – Issuu

SigEp Journal – Spring 2014 by Sigma Phi Epsilon – Issuu During January, its first month of operations, Dieker Company accumulated the following manufacturing costs: Raw materials $4,500 on account, factory labor $8,100 of which $5,300 relates to factory wages payable and $2,800 relates to payroll taxes payable, and factory utilities payable $2,700. Required:

Solved Brief Exercise 2-2 During January, its first month of | Chegg.com Answered: The following partially completed… | bartleby Question: During January, its first month of operations, Dieker Company accumulated the following manufacturing costs: raw materials $5,700 on account, factory labor $6.300 of which $5.500 relates to factory wages payable and $800 relates to payroll taxes payable. and factory utilities payable $2,700 Prepare separate journal entries for each typ